So You've Built a Successful Business...

Now What?

Unlock Proven Strategies to Increase Business Value while Allowing it to Thrive Independent of Your Involvement.

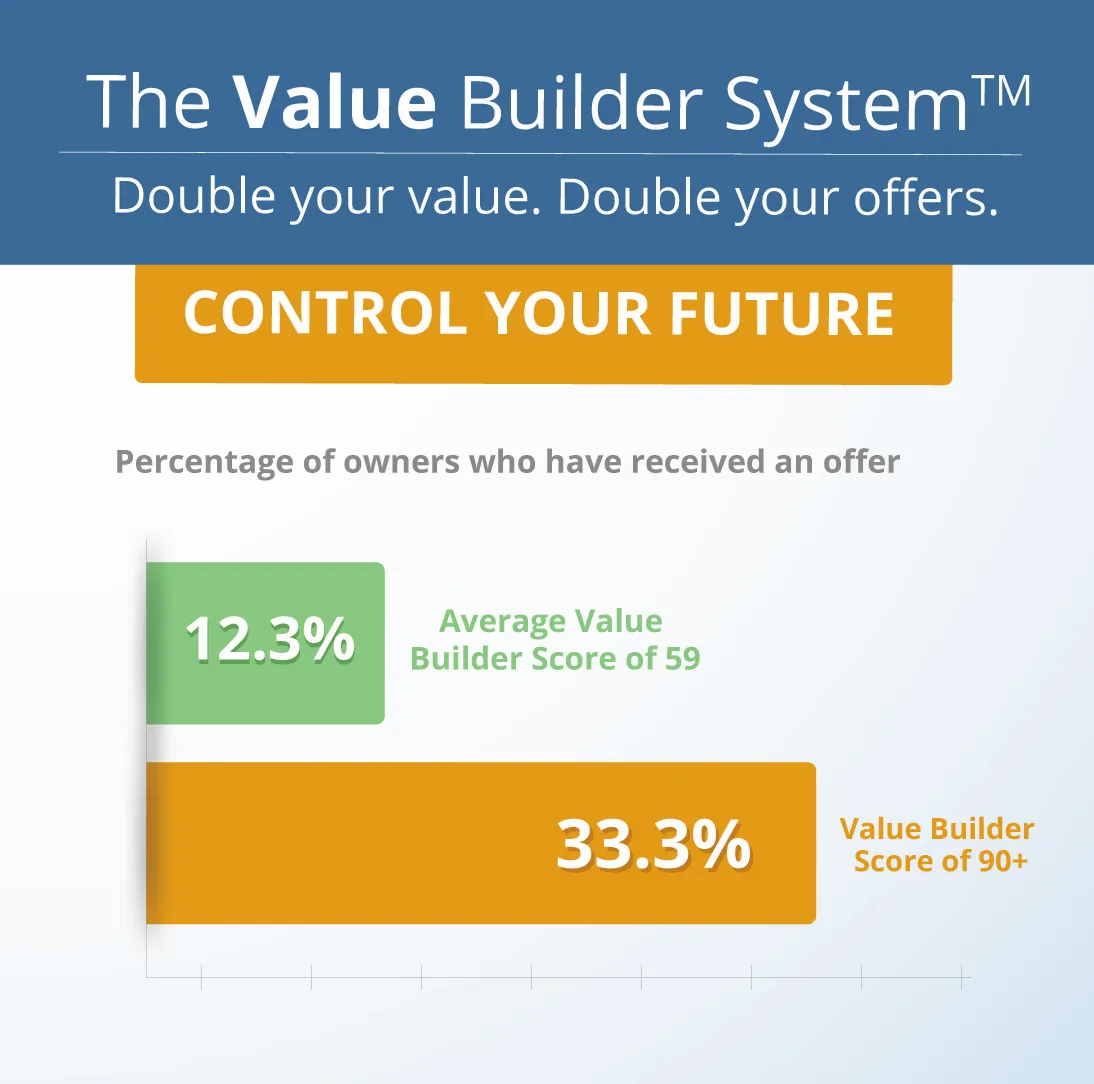

The Value Builder System™

Our Value Builder System™ is a guided, step-by-step process meticulously crafted to detach you from the day-to-day operations of your business, amplifying its value and returning control over your time.

Exclusive to our members, our monthly workshops guide you through the wealth of resources, ensuring you not only understand each lesson but leave with a concrete action plan ready for implementation.

The 8 Key Drivers of Company Value

As an owner, your business is not just a source of income; it’s an investment.

From financial performance and growth potential to customer satisfaction and the business’s reliance on your personal involvement, we’ll explore in detail the eight key factors that drive business value.

Whether you want to sell your business now or decades into the future, getting your Value Builder Score will allow you to:

Diagnose what may be holding you back from creating a company that can fully thrive without you.

See how an acquirer would evaluate your business, enabling 1 Columnyou to focus today on what will be important down the road.

Identify hidden things that may quietly drag down the value of your business so you can eliminate them before they become a problem.

Pinpoint the part of your business that will have the most value to an acquirer so you can invest more resources in areas likely to be most attractive to an investor or acquirer.

The 8 Key Drivers of Company Value

Driver #1: Financial performance

Financial performance in the Value Builder Score framework begins with your revenue. The underlying assumption is straightforward: Larger companies are less owner dependent.

When revenue grows, so does the infrastructure, making it easier for an acquirer to see the business as a turnkey operation. High revenue serves as a proxy for a wide customer base and diverse service or product offerings.

Driver #2: Growth Potential

Buyers invest in future returns; thus, a company brimming with growth potential significantly elevates its market valuation.

The concept behind growth potential is straightforward yet deeply impactful: Companies that not only succeed now but also show promise for future growth command higher market valuations.

High growth potential lessens investment risk and amplifies potential returns, making these companies attractive prospects

for acquirers.

Driver #3: The Switzerland Structure

In the quest for maximum business valuation, leaders often fixate on growth metrics like revenue, market share, and profitability. One often overlooked but critical factor is the Switzerland Structure - a company’s ability to function without an overreliance on any single customer, supplier, or employee.

Driver #4: The Valuation Teeter Totter

Simply put, the less cash your company needs for daily operations, the more valuable it becomes. Conversely, if your business

requires significant working capital, its market valuation diminishes. These two variables—cash need and business valuation—operate in lockstep but move in opposite directions.

The reason behind this inverse relationship is straightforward but crucial: When an acquirer buys a business, they essentially write two checks. The first check goes to the owner for the value of the business. The second check is for the company itself to fund its working capital—the money that needs to be in the bank the day you hand over the keys. The more cash an acquirer needs to set aside for working capital, the less they are inclined to pay for the overall acquisition.

Driver #5: Recurring Revenue

Recurring revenue is more than just a buzzword; it’s a valuation multiplier. As a critical component in the Value Builder Score, it

enhances a business’s attractiveness and fundamental worth.

Traditionally associated with software and service industries, recurring revenue models are making inroads into sectors where

they are less common, amplifying business value.

Driver #6: Monopoly Control

Monopoly control, an intriguing component of the Value Builder Score, is a term inspired by Warren Buffett’s investment strategy.

As businesses aim for a larger competitive moat, they gain pricing authority, which subsequently leads to better gross margins, higher EBITDA, and, ultimately, an elevated business valuation.

Driver #7: Customer Satisfaction

Customer satisfaction is not merely a nicety; it’s a vital driver of long-term business value. Within the Value Builder Score framework, key metrics like customer satisfaction and the likelihood of receiving customer referrals serve as crucial drivers of your performance on your Customer Satisfaction score.

The nexus between customer satisfaction and business valuation is strong and multi-dimensional. Satisfied customers are more

likely to return and to recommend your business, serving as both a revenue generator and a cost-saving marketing channel.

Driver #8: Hub & Spoke

To score well on Hub & Spoke, you need to avoid being a Hub & Spoke manager. A Hub & Spoke manager is a leader that is central to all company operations. Employees turn to this leader for decisions, making the manager the “hub” and everyone else the “spokes.” This setup is a bottleneck, hindering growth and agility.

It makes the business heavily reliant on one person, lowering its valuation. Potential buyers see increased risk and may walk away or offer less. It’s a poor strategy for business owners aiming to build a sellable asset.

A business run by a Hub & Spoke manager functions with the owner at its center, with employees, clients, and suppliers orbiting

as the spokes. Every decision, no matter how minor, routes through the owner. Such a centralized mode of operation may offer short-term benefits, but its long-term costs—reduced agility, limited growth, and diminished valuation—can be devastating.

© 2023 Better Way Coaching LLC. All Rights Reserved. Privacy Policy. Terms & Conditions